- At the end of the bidding session, bids for each 15 minute time block are matched using the price calculation algorithm. (available in IEX bye-laws)

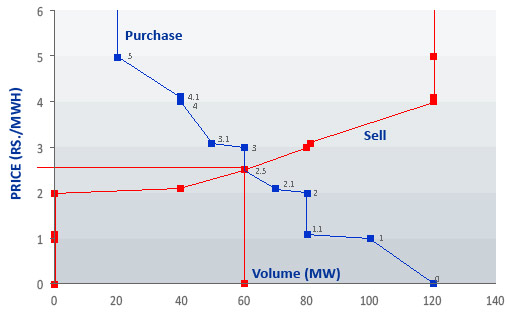

- All purchase bids and sale offers are aggregated in the unconstrained scenario. The aggregate supply and demand curves are drawn on Price-Quantity axes. The intersection point of the two curves gives the market clearing price (MCP) and market clearing volume (MCV) corresponding to price and quantity of the intersection point.

- MCP and MCV are determined for each block of 15 minutes as a function of demand and supply which is common for the selected buyers and sellers.

- Selected members are intimated about their partially or fully executed bids and other trade related information.

- By 1145 hrs, transmission corridor required to fulfill successful transactions are sent to NLDC.

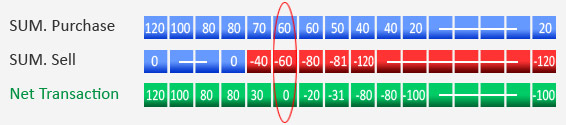

The example below illustrates price calculation. Assume the price tick as below:

For the sake of simplicity we assume only 3 portfolios are entered. The quantity entered by each portfolio A, B and C for the specific price tick is as shown below:

The algorithm will then add the entire purchase quantum and sell quantum after the bidding session and look for a solution where the net transaction is zero i.e. the buy quantum is equal to the sell quantum.

The demand-supply graph in such scenario is shown below: